Table of Contents

Procurement professionals are under constant pressure to reduce costs, ensure supply reliability, and align supplier partnerships with broader business goals. One essential tool that supports smarter, data-driven decisions in this space is cost-benefit analysis (CBA). When applied to supplier contracts, CBA helps organizations look beyond the surface-level numbers and understand the true value or risks embedded in a deal.

Performing a procurement cost-benefit analysis enables decision-makers to systematically evaluate both the tangible and intangible benefits and costs of a contract. It also helps avoid costly assumptions, identify hidden pitfalls, and justify choices to stakeholders across finance, operations, and compliance teams.

In this guide, you’ll learn how to perform a supplier contract CBA step-by-step, what costs and benefits to consider, and which mistakes to avoid. Whether you’re sourcing a new vendor, renewing an existing contract, or renegotiating terms, this methodology provides clarity and confidence in your decisions.

What is a Cost-Benefit Analysis (CBA)?

A cost-benefit analysis is a systematic approach for assessing both the monetary and strategic implications of a potential choice. In the context of supplier contracts, it enables businesses to evaluate the total value a supplier provides in comparison to the total cost of working with them.

Rather than relying on intuition or surface-level price comparisons, CBA provides a data-backed way to answer questions like:

- “Is Supplier A more cost-effective over three years than Supplier B, even if their per-unit cost is higher?”

- “Will a cheaper supplier increase our quality control issues and operating costs?”

- “Are the long-term benefits of a strategic partnership worth the upfront investment?”

CBA can be applied in several procurement scenarios:

- Selecting between competing supplier bids.

- Justifying a contract renewal or extension.

- Evaluating whether to switch suppliers.

- Assessing the value of new contract terms, such as volume discounts or performance incentives.

By grounding decisions in data, CBA reduces bias, reveals trade-offs, and supports the creation of long-term value.

Importance of a Cost-Benefit Analysis in Procurement

A supplier’s quoted price often fails to capture the full picture of what they truly deliver over time. So, a thorough cost-benefit analysis is necessary to help procurement teams:

1. Make Informed, Objective Decisions

Cost-benefit analysis makes supplier evaluations more transparent and consistent. It shows all teams, like procurement, finance, and operations, exactly how and why a decision was made.

2. Avoid Hidden Costs and Missed Opportunities

Onboarding a supplier with a low quote but poor service levels may result in higher total costs due to rework, delays, or compliance failures. CBA surfaces these risks early.

3. Improve Vendor Performance Management

By tracking the benefits and costs of supplier contracts over time, organizations can better monitor performance and hold vendors accountable.

4. Strengthen Internal Business Cases

Procurement often needs to justify supplier selections to senior leadership or budget owners. A CBA provides a quantifiable, defensible rationale.

Also Read: Procurement Cost Analysis: Best Techniques to Master Efficiency

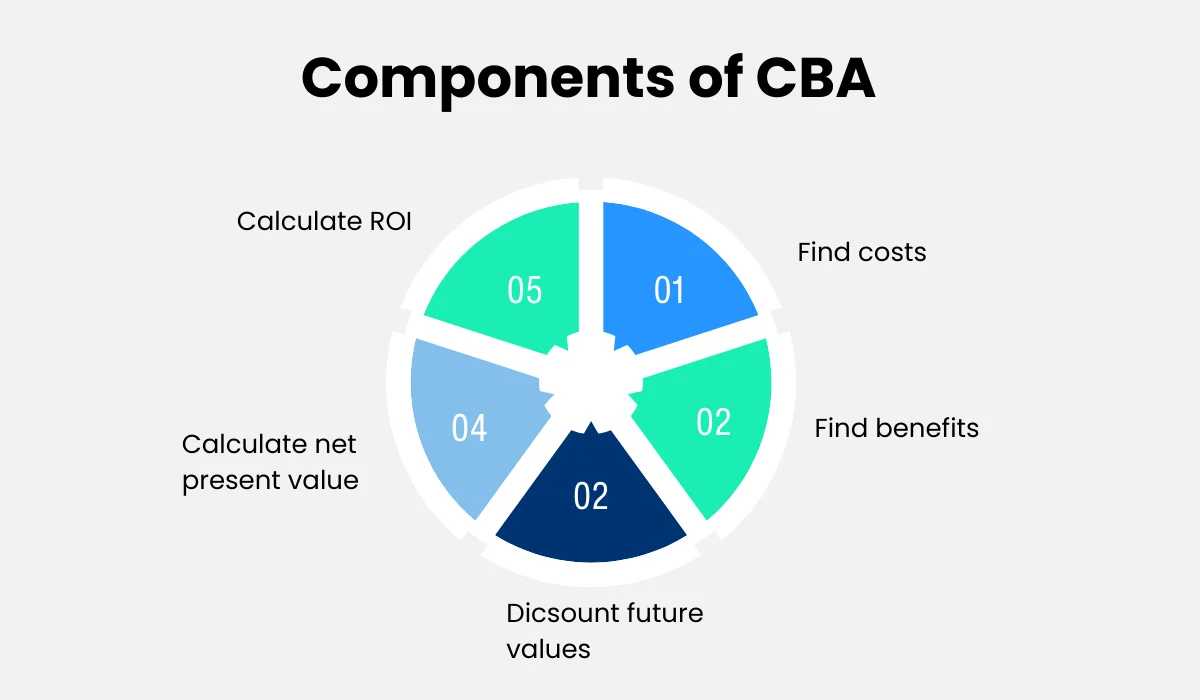

Key Components of a CBA

To build an accurate and useful CBA, you must identify both the costs and benefits across direct, indirect, short-term, and long-term factors.

Consider Different Costs

Direct Costs

- Unit prices: Base prices for goods or services.

- Shipping and logistics: Freight, duties, taxes, warehousing.

- Onboarding costs: The time and resources required to integrate new suppliers.

- Customs and tariffs: Especially for international suppliers.

Indirect Costs

- Downtime and disruptions: Caused by late deliveries or stockouts.

- Quality issues: Returns, rework, or warranty claims.

- Compliance and legal risk: Costs of managing certifications, audits, and legal exposure.

- Switching costs: Contract termination fees, retraining staff, updating systems.

Consider the Benefits of Each Cost

- Lower Total Cost of Ownership (TCO)

A supplier might offer better equipment durability, fewer maintenance needs, or bundled services that reduce overall spending.

- Payment Flexibility: Extending payment schedules or linking payments to project milestones can help maintain healthier cash flow.

- Delivery Performance: Reliable lead times reduce inventory holding costs and production delays.

- Innovation or Value-Added Services: Some suppliers invest in co-development, offer automation tools, or contribute to product innovation.

- Strategic Alignment

Suppliers that align with your ESG goals, localization strategy, or vendor diversity targets may offer intangible but important strategic benefits.

How to Perform a Procurement Cost-Benefit Analysis

Step 1: Define the Objective

Start by clearly stating what you’re trying to achieve. Are you reducing procurement costs? Or improving lead times or service levels? Or meeting ESG or regulatory standards?

Clarify the scope and timeframe. Are you comparing three suppliers for a two-year contract? Are you analyzing a potential renewal for a mission-critical vendor?

Step 2: Identify and List All Costs

Capture all relevant costs, both visible and hidden. Use procurement history, quotes, and supplier scorecards. Engage cross-functional teams such as legal, finance, logistics, and operations, to capture a complete picture and prevent overlooked factors. Benchmark costs using market rates or third-party data where needed.

Break down costs into categories:

- Upfront vs ongoing

- Direct vs indirect

- Financial vs operational

Step 3: Identify and List All Benefits

Quantify benefits wherever possible.

Tangible: $100,000 saved annually through better payment terms.

Intangible: Faster issue resolution improves customer satisfaction.

Tie each benefit back to a business goal- cost savings, resilience, compliance, etc. Use a rating system for intangible benefits if needed (e.g., low/medium/high impact).

Step 4: Quantify and Compare Costs and Benefits

Now translate your findings into numbers:

Net Benefit = Total Benefits – Total Costs

The Benefit-Cost Ratio (BCR) is calculated by dividing the total projected benefits by the total estimated costs. A BCR greater than 1 indicates the benefits outweigh the costs. Comparing the BCR across supplier options helps rank them based on overall value.

Step 5: Interpret Results and Make a Decision

Evaluate both financial results and strategic alignment. For example, a supplier with a lower net benefit might still be chosen if they offer critical strategic advantages (e.g., geographic proximity, data transparency, innovation).

Now document all assumptions made (e.g., forecasted volumes), any risks or uncertainties, and the rationale behind the final choice. This documentation supports audits, stakeholder questions, and future reviews.

Also Read: Manufacturing Cost Analysis: What You’re Doing Wrong (and How to Fix It)

Tools and Templates for CBA

While you can conduct a procurement cost-benefit analysis manually, using the right tools enhances accuracy and efficiency. Here are a few recommended tools:

Spreadsheets: Ideal for building custom CBA models with formulas, charts, and sensitivity analyses.

Procurement platforms: Systems like Cost It Right offer CBA templates and supplier comparison features.

BI Tools: Platforms like Power BI or Tableau help visualize supplier performance and contract value over time.

What Not to Do When Doing Cost-Benefit Analysis

Avoid these frequent mistakes that weaken the effectiveness of a supplier CBA:

- Focusing Only on Price: A low unit price doesn’t mean lower total cost. Ignoring quality, service, and long-term impacts can backfire.

- Overlooking Indirect Costs: Delays, poor communication, and compliance issues are real costs, even if they don’t show up on the invoice.

- Not Involving Key Stakeholders: Procurement may not see all the operational impacts. Engage legal, finance, and operations teams early to gain a comprehensive view.

- Letting the CBA Go Out of Date: Market conditions, supplier performance, and business priorities change. Refresh your CBA periodically, especially before renewals.

Conclusion

Supplier contracts are more than transactional documents; they shape the performance, resilience, and cost-efficiency of your entire supply chain. A structured, well-executed cost-benefit analysis ensures that supplier decisions are based on value rather than guesswork.

By accounting for both the hard numbers and strategic implications, cost-benefit analysis enables procurement teams to strike the optimal balance between cost, quality, risk, and innovation. This approach supports more informed sourcing choices and helps build more resilient, high-performing supplier partnerships.